Product Information

BusinessSuite Accounting – The perfect tool for your business.

BusinessSuite Accounting is a diverse business management package, designed for businesses in all

markets and industries. The software includes all of the core accounting functionality you

would expect of a total business solution, as well as being easy to use, fully multi-user and network aware.

Select an option to find out more details...

GST Module

The GST module is used to transfer amounts from the transactions that have occurred throughout BusinessSuite during your day to day use. This information is then used to assist your accountant in filling in the Business Activity Statement that every business is required to submit to the Australian Taxation Office.

The information is also posted through to a supplier (called the ATOGST for example), where you can make your payments and perform your reconciliations. You can also use this account for other amounts such as the PAYG withholding amounts from employee wages.

Key Features:

Supports Cash or Accruals collection

Monthly or Quarterly reporting

Calculate including GST or excluding GST prices

Collect, verify and report information in one process

Integrates with all modules so no double entry is needed

Details:

| Cash Or Accruals | |

| BusinessSuite supports Cash and Accruals collection methods without any manual intervention required. For Cash collection, all of the transactions are only collected once they have been paid for (whether customers or suppliers). For Accruals collection the transactions are collected according to the period in which they are made. | |

| Monthly or Quarterly | |

| BusinessSuite understands the reporting periods and can differentiate between transactions for the current period and adjustments to collections for prior periods. If a transaction is made for an earlier date, it will automatically be recorded as an adjustment entry. | |

| Including or Excluding | |

| BusinessSuite can calculate selling prices including or excluding GST. Once you have selected which method to use, amounts entered into any of the sales modules will then calculate themselves. The reports and screen formats change according to this setting, so that you are looking at the information in the same way as you have specified. Using pricing excluding GST allows you to input all excluding GST selling prices. GST is then added to the amount, and the total is shown. For example a $100 sale plus $10 of GST equals $110, with all three figures displayed to add to the total. This is best for wholesale companies. Pricing including GST allows you to input the final customer prices, and the program will calculate the GST amount. For example a $110 sale would include $10 of GST, and would display accordingly. This is best for retail companies. | |

| Collection | |

| As you perform transactions within BusinessSuite, such as creating invoices and orders, charging fees and so on, all GST amounts are tracked and recorded by the program. The purpose built GST module gives you all the access to this information that you will ever need. The Transfer tab of the module displays the details of each GST Transfer that you perform. What a GST Transfer does is collect all the GST information from the various parts of the program and give you a Net GST value - or in other words, the amount the Tax Department is owed (a minus value indicates a refund). Performing this Transfer is as simple as setting the GST period and clicking the Go button. |

|

| Business Activity Statement | |

| When you perform a transfer, the program automatically fills in the Business Activity Statement tab. The tab contains a number of G-Code fields that correspond to those on the BAS sheet. This means filling out the GST totals on the BAS is as easy as printing out the Transfer report and copying the figures to the BAS. |  |

| Tracking | |

| As well as automatically filling out your G-Code fields, BusinessSuite’s GST module contains tabs that display every calculation performed to arrive at these figures. During a Transfer, the GST information is collected and stored on a module by module basis. The two types of transactions (purchases and sales) have their respective detail tabs in the GST module. For example, the Invoicing Tab in the Sales Details tab shows all the amounts collected from the Invoicing module and the G-Code locations where they have been sent for the BAS. As well as this extensive tracking, BusinessSuite gives you a calculation page for each G-Code field. The tabs within the G Summary tab display each G-Code and the information used to calculate the final amount that was recorded on the BAS. For example, the G1 tab in the G Summary tab displays all of the values and calculations used to reach the G1 figure, including Invoicing, Point of Sale, Transport and Customers. |

|

| Reports | |

| The available reports in the GST module let you print such important information as a GST balance report, GST Transfer information and detailed reports for each module. |  |

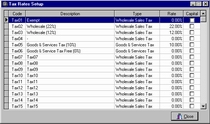

| Tax Rates | |

| The GST tax rates are configured in one location in BusinessSuite, so that if the rates were to change they would only need to be changed in one place. |  |

| Purchasing | |

| All purchasing in BusinessSuite is done excluding GST, regardless of the setting for the selling prices. This allows you to easily separate off the cost of the items with the GST that you have paid. The reporting for Gross Profit and so on will also then show the correct margins, as all figures will be reported excluding GST. |

|

| Suppliers | |

|

When you perform a GST Transfer, there is a field that lets you select the GST Payments Account Code. This code is the account where the Net GST Balance figure is sent. This also allows you to see the history and balances of the account, as you would for any other supplier. Using the Suppliers Activity module you can make payments and adjustments to the ATO account and reconcile these transactions to make sure that you are paying correctly. |

|

Copyright © BusinessSuite Australia. All Rights Reserved.